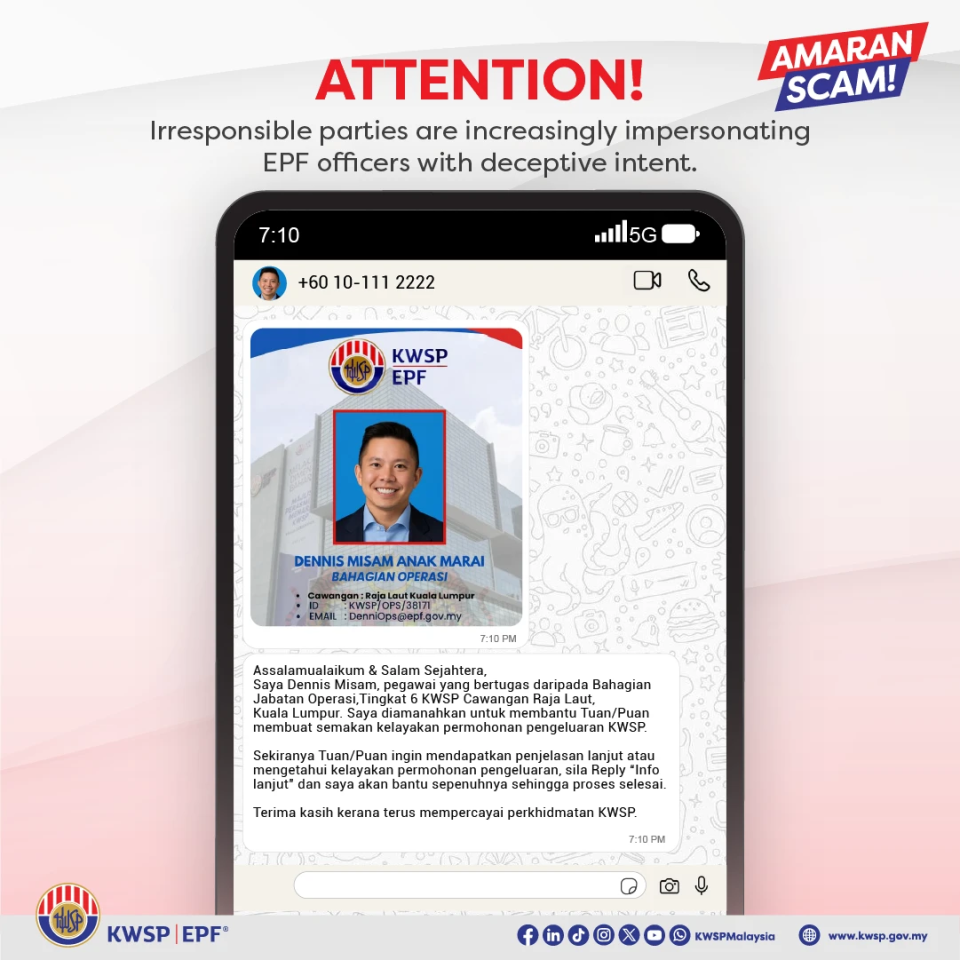

As of late, there have been irresponsible parties impersonating EPF officers to deceive the public by misusing EPF’s name and logo to appear official, including promoting fake withdrawal offers.

Therefore, the EPF would like to remind all members to always stay cautious and never fall for suspicious messages or phone calls claiming to be from the EPF, as carelessly trusting or sharing your personal details could cause your hard-earned savings to disappear without a trace.

✅ Do not be easily deceived by names or logos that look official.

✅ Always verify the authenticity of information through EPF’s official website and social media before sharing any personal details.

Remember, if in doubt – do not share your personal details. A little caution goes a long way in protecting your retirement savings from being misused by irresponsible parties.

#KWSP

#KWSPAntiScam

About the Employees Provident Fund® (EPF®)

The Employees Provident Fund® (EPF®) is Malaysia’s premier retirement savings fund, helping its members achieve adequate savings for a comfortable retirement. This is in line with EPF’s purpose to build a better retirement future for Malaysia and its mission to helping members achieve a comfortable retirement income. The EPF has evolved significantly from a transaction-centric to a professional fund management organisation with a strong focus on retirement security. The EPF is guided by a robust and professional governance framework when making investment decisions. It continues to play a catalytic role in the nation’s economic growth and seeks to cultivate a savings and investment culture among its members to improve the country’s financial literacy level.